“There is no better teacher than history in determining the future…there are answers worth billions of dollars in a thirty-dollar history book.”

–Charlie Munger (1924–2023), Vice Chairman of Berkshire Hathaway

Volume 21

Rate Cuts

Begin: Insights from Past and Present

What Happened in the Markets

Subscribe and start receiving the Atlas Memo directly to your email

Imagine the economy as a grandfather clock. When times are tough, the Federal Reserve (The Fed) winds up the clock by cutting interest rates, hoping the pendulum will swing toward growth and recovery. When inflation heats up, they tighten the spring, hiking rates to slow things down. For the last few years, we’ve watched the Fed wind up and tighten with remarkable speed, hiking rates to combat post-pandemic inflation. But now, the pendulum

has begun its return journey: rate cuts are back on the table, and the landscape has shifted again. This month’s memo explores this transition, what history tells us about such shifts, and where we might go from here.

The Fed’s recent pivot from a hawkish rate-hiking stance to a more dovish rate-cutting regime marks a significant change in monetary policy. Just as the central bank aggressively raised rates in 2022 to tame inflation, they’ve now cut rates by 50 basis points, bringing the

federal funds rate down to the 4.75-5.00% range. Though anticipated, this move has stirred discussions on its implications for the economy and financial markets.

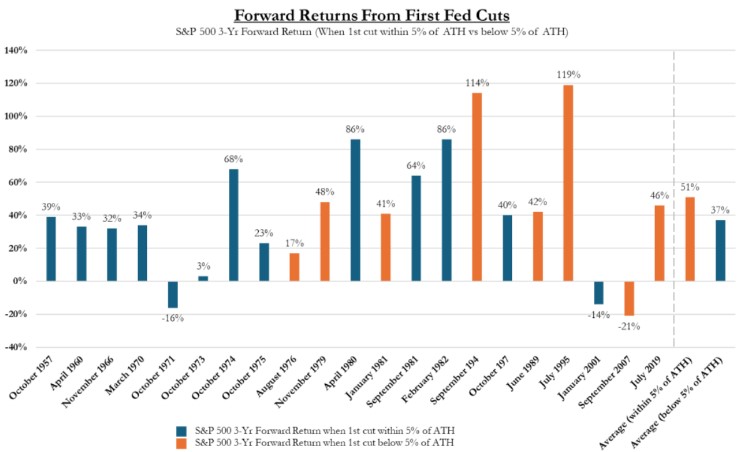

History is our best guide when navigating economic terrain—as the quote above from Charlie Munger reminds us. The Fed’s decision to cut rates near all-time highs in the stock market is not unprecedented. As shown below, the S&P 500 has been in similar

circumstances throughout history. The stock market was higher three years later in the last six out of seven similar instances since 1957. This is good news for investors, suggesting that the initial fears of recession or market collapse are perhaps overblown. However, eachhistorical moment has its own unique variables, and the current scenario is no exception.

A historical example worth noting is the 1995 rate-cutting cycle. Under Alan Greenspan, the Fed managed a series of rate cuts that contributed to one of the longest economic expansions in US history. The cuts were part of a strategy to preemptively support a slowing economy without triggering inflation. This “soft landing” scenario is what many hope the current Fed can replicate. But achieving such outcomes is as much about luck as it is about skill.

However, not all rate cuts lead to smooth sailing. For instance, the rate cuts of 2001 and 2007 came amid recessions and were insufficient to prevent economic downturns. This shows that while rate cuts can support the economy—they are not a cure. Timing and context are crucial.

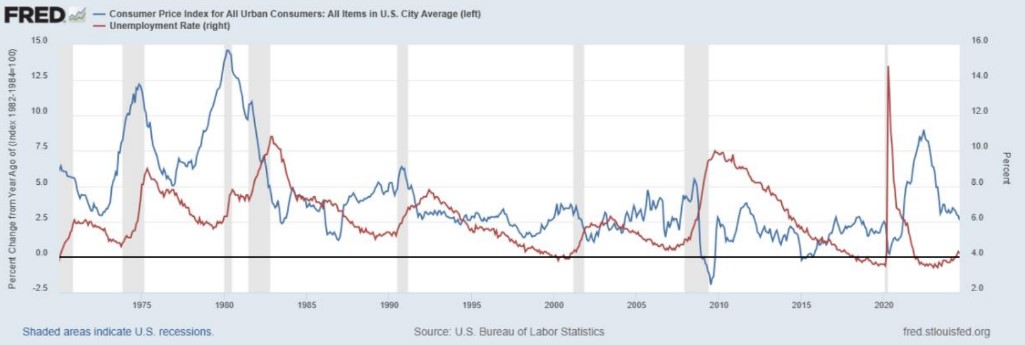

Several factors contributed to the Fed’s decision to initiate rate cuts despite the absence of a recession. The aggressive rate hikes of 2022 successfully brought down inflation, which is evident in the accompanying chart. The blue line shows a sharp decline in the Consumer Price Index (CPI) after peaking in 2022, demonstrating the effectiveness of the Fed’s tightening cycle. However, the chart also reveals that the unemployment rate (red line) has remained relatively low, hovering around 4%. With inflationary pressures easing, the Fed is now shifting focus towards supporting the labor market. By cutting rates, the Fed aims to sustain economic growth and employment, avoiding any significant uptick in unemployment. This preemptive approach is designed to maintain the balance between price stability and maximum employment, ensuring that the economy remains stable despite external risks.

Fed Chair Jerome Powell’s comments highlight the Fed’s desire to act preemptively rather than reactively. While the economy is not in recession, the decision to cut rates now aims to sustain growth and employment rather than waiting for a downturn to force its hand.

Markets typically welcome rate cuts as they signal easier financial conditions ahead. The recent 0.5%-point cut was no exception. The S&P 500 jumped 1.7% following the announcement, reaching a new record high. Historically, stocks tend to perform well in the year following an initial rate cut, especially when the cuts occur near market highs. The S&P 500 has historically added nearly another 20% in the 12 months following an initial rate cut under such conditions.

This doesn’t mean the road ahead is without bumps. Market volatility is a given, and the current geopolitical climate and lingering inflationary concerns could still create headwinds. However, the immediate outlook appears positive, especially for sectors like technology, real estate, and small cap stocks, which historically perform well after rate cuts.

The economic impact of rate cuts is more nuanced. Lower rates reduce borrowing costs, which can stimulate spending and investment. This, in turn, supports economic growth and employment. However, as Ben Carlson of Ritholtz Wealth Management points out, rate cuts don’t guarantee a recession or a surge in inflation. They are a tool, not a silver bullet.

Moreover, the current economic backdrop is unique. The pandemic’s lingering effects, unprecedented fiscal stimulus, and a

labor market that has shown remarkable resilience despite tightening monetary conditions have created mixed signals. This

makes predicting the economic outcome of this rate-cutting cycle particularly challenging.

While the market’s initial response to the rate cuts has been positive, several risks remain. Firstly, the possibility of a policy

mistake looms large. If the Fed cuts rates too aggressively, it risks reigniting inflation. Conversely, if it cuts too slowly, it might

not provide the necessary support to sustain economic growth.

Furthermore, the global economic situation is filled with uncertainty. Geopolitical tensions could disturb global trade and

economic stability, especially in Europe and Asia. The interlinked nature of modern economies implies that global events impact

domestic monetary policy. Looking ahead, several scenarios could play out.

As we transition into this new monetary regime, it is crucial to remember that rate cuts—while generally positive for markets—

do not guarantee smooth sailing. The interplay between inflation, employment, and global economic conditions will dictate the

success of this policy shift. Investors and policymakers should closely monitor these variables and be prepared for various

outcomes—we are at Atlas. History provides some guidance, but as we’ve learned, each economic cycle writes its own unique

story.

In the end, much like our hypothetical grandfather clock, the pendulum will keep swinging. Our task is to keep it moving in a

way that maintains balance and stability—no matter the direction it swings.

September exceeded expectations as markets were lifted by the first

interest rate cuts since March 2020. While September is historically

the weakest month for markets, it outperformed January, July, and April this year. Although volatility returned, it remained below the levels seen in August.

The S&P 500 rose by 2.1%, with mid-cap stocks gaining 1.1% and small caps up 0.7%. International equities also posted strong gains, with developed markets returning 2.6% and emerging markets having a standout month, surging 5.7%. Each of these equity markets is positive year to date.

Fixed income markets were also positive, with US Treasuries rising 1.2% and the US Aggregate Bond Index up 1.3%. Bank loans and high-yield bonds also delivered gains of 0.5% and 1.6%, respectively.

As the month came to an end, the financial markets experienced a strong finish, indicating a positive outlook as we move closer to the US Presidential Election.

As the Chief Investment Officer, Stephen Swensen oversees investment management, research, portfolio design, and all investment-related operations at Atlas. He also chairs the Atlas Investment Committee, guiding strategic investment decisions.

Stephen’s career began as a Financial Analyst for Deseret Mutual Benefits Administration (DMBA), a role in which he managed investments for a private pension fund and insurance company. Subsequently, he served as an investment analyst and portfolio manager for local Registered Investment Advisors (RIAs). Before joining Atlas, Stephen contributed his expertise as an Outsourced Chief Investment Officer (OCIO) for the Carson Group, supporting advisors on the West Coast. Educationally, Stephen holds an MBA and an MS in Investment Management and Financial Analysis from Creighton University. He has earned the Series 65 Uniform Investment Advisor License and is actively pursuing the prestigious

Chartered Financial Analyst (CFA) designation.

Beyond his professional achievements, Stephen is an enthusiastic hockey fan, both on and off the ice. He finds joy in playing the piano, golfing, reading, and outdoor cooking. However, his greatest source of happiness comes from spending quality time with his wife and four children

NOTICE REGARDING INVESTMENT DISCLOSURES: The contents of this memo reflect the opinions of the author(s) as of the indicated date and are subject to change without notice. Atlas Investment Management has no obligation to update the information provided here. It should not be assumed that past investment performance guarantees future results. Potential for profit also entails the risk of loss.

The information presented is believed to be current and is not personalized investment advice. All opinions expressed are as of the date of the presentation and may change over time. All investment strategies carry the potential for profit or loss. Asset allocation and diversification cannot guarantee improved returns or eliminate the risk of investment losses. Target allocations may deviate due to market conditions and other factors. There is no guarantee that any investment or strategy will be suitable or profitable for an investor’s portfolio. Different types of investments involve varying levels of risk.

The charts and slides do not depict the performance of Atlas Investment Management or any of its advisory clients. Historical performance returns for investment indexes and/or categories typically do not factor in transaction and/or custodial charges or an advisory fee, which may decrease historical performance results. There is no assurance that an investor’s portfolio will match or exceed a specific benchmark.

This communication, including any attachments, is intended exclusively for the addressee and may contain proprietary, confidential, or privileged information. Unauthorized use, copying, disclosure, dissemination, or distribution is strictly prohibited. If you are not the intended recipient, please immediately notify the sender by return email, delete this communication, and destroy all copies.

Securities are offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC, headquartered at 80 State Street, Albany, NY 12207. Investment Advisory services are offered through Ignite Planners, LLC. Purshe Kaplan Sterling Investments and Ignite Planners, LLC are not affiliated companies. Ignite Planners, LLC conducts business only in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission and does not imply that the advisor has achieved a particular level of skill or ability. All investment strategies carry the potential for profit or loss.