The global economic landscape is undergoing transformative shifts driven by rapid technological innovation, evolving monetary policies, and changing consumer behaviors. This whitepaper examines how these forces are reshaping traditional investment strategies and provides actionable insights to help investors thrive in this new era. Key themes include:

This paper emphasizes the importance of adaptability, strategic foresight, and teamwork—qualities essential for navigating uncertainty and achieving long-term investment success. By embracing innovation, recalibrating traditional metrics, and maintaining diversification, investors can build strategies designed to succeed in a rapidly changing economic environment.

The global economy has undergone profound transformations in recent years, driven by the accelerating pace of technological innovation, evolving monetary policies, and shifting patterns in consumer behavior. These changes present complex challenges but also substantial opportunities for investors equipped with the foresight and adaptability to respond effectively.

As Chief Investment Officer at Atlas Investment Management, I seek to articulate a nuanced perspective on these developments and foster a deeper strategic dialogue with stakeholders. This whitepaper explores the intricacies of these shifts, offering actionable insights and a roadmap for navigating an increasingly interconnected and volatile global economic landscape.

The convergence of these factors has redefined traditional investment paradigms, compelling market participants to rethink established approaches. As technological disruptions reshape industries, monetary policies address unprecedented challenges, and global interconnectedness deepens, the need for a robust and dynamic framework to interpret these shifts becomes increasingly apparent. In this context, synthesizing data, anticipating trends, and implementing strategies aligned with macroeconomic realities constitutes a significant competitive advantage.

To illustrate these complex issues, I draw from relatable scenarios, including the strategic dynamics of hockey—a sport I am deeply passionate about as both a player and coach. My time on the ice, whether competing or guiding a team, has reinforced critical lessons about preparation, adaptability, and teamwork—qualities that are equally essential in navigating the financial markets. Just as success in hockey hinges on strategic planning, split-second decision-making, and resilience under pressure, thriving in financial markets demands a similar balance of foresight, agility, and responsiveness to change. These parallels form a thematic foundation for this analysis, highlighting how the principles of situational awareness and adaptability drive success in both arenas.

By harmonizing diverse portfolio components to achieve long-term objectives, investors can take lessons from dynamic and fast-paced environments to enrich their strategic toolkit. This paper aims to equip investors with the tools to approach uncertainty with confidence and precision, helping them capitalize on opportunities in an ever-changing global economic system.

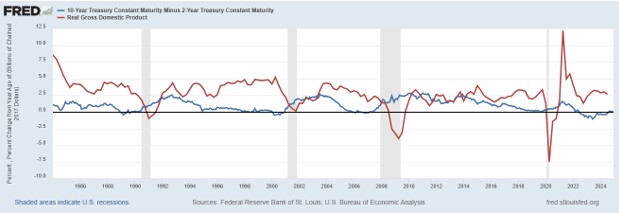

Historically, the yield curve has been a reliable barometer of economic health, with its inversions often presaging recessions. However, the yield curve’s recent behavior has defied traditional interpretations. As Gilbert (2024) posits, the uninversion of the yield curve reflects shifting market anticipations regarding the Federal Reserve’s monetary policy trajectory and the resilience of broader economic conditions.

Despite fears of recession sparked by the yield curve’s inversion in July 2022, the US economy demonstrated unexpected robustness. Real GDP expanded at an annualized rate of 2.8%, surpassing the pre-pandemic decade’s average of 2.4%, while the S&P 500 appreciated by over 40% from July 2022 to August 2024. This resilience underscores the necessity of contextualizing traditional economic indicators within the prevailing macroeconomic milieu rather than relying solely on historical precedents.

The accompanying graph illustrates the relationship between the 10-year Treasury constant maturity minus the 2-year Treasury constant maturity (yield curve) and the year-over-year percent change in real GDP. Historically, periods of yield curve inversion (when the blue line dips below zero) have preceded recessions, as indicated by the shaded areas on the graph. Notably, the yield curve inversion in 2022 did not lead to an immediate economic contraction, as evidenced by continued GDP growth through 2024. This deviation highlights the importance of contextualizing traditional economic indicators within the broader macroeconomic environment, as structural shifts in monetary policy and market resilience may alter historical patterns of causality. The graph underscores the dynamic interplay between short- and long-term economic expectations, illustrating how these metrics must be analyzed alongside real economic outcomes for accurate forecasting.

This scenario can be likened to an underdog hockey team maintaining an unexpected lead. The lesson here is the importance of reassessing established metrics to align with current realities. As a hockey coach recalibrates strategies mid-game in response to shifting dynamics, investors must adapt their interpretive frameworks to the evolving economic landscape.

The Federal Reserve’s aggressive tightening cycle reflects a defensive strategy akin to protecting a lead. While this approach succeeded in restraining inflationary pressures, it also tempered economic growth and heightened market volatility. Recent policy shifts—including a 0.50 percentage point rate cut in September 2024—signal a transition toward balancing labor market support with inflation control (Varghese, 2024a).

The deceleration in monthly job creation, from 290,000 at the start of 2023 to approximately 120,000, highlights structural and cyclical challenges. Factors such as diminishing catch-up hiring and heightened pre-election uncertainty have contributed to this slowdown (Goldman Sachs, 2024e). Policymakers now face the complex task of maintaining economic momentum while mitigating emerging risks, akin to a hockey coach dynamically adjusting strategies in response to evolving game conditions.

The technological sector, particularly advancements in artificial intelligence (AI), has fundamentally reshaped traditional business models and valuation paradigms. Nvidia exemplifies this transformative shift by pioneering accelerated computing technologies that have propelled the company to the forefront of AI-driven innovation (Huang, 2024).

This evolution mirrors the integration of advanced analytics into hockey, where teams increasingly leverage data to enhance player performance and optimize strategies. Nvidia’s holistic ecosystem—encompassing hardware, software, and applications—demonstrates how strategic integration fosters sustainable competitive advantages. Similarly, identifying and investing in nascent AI applications offers unique opportunities for forward-thinking investors, much like scouting emerging hockey talent before their breakout seasons.

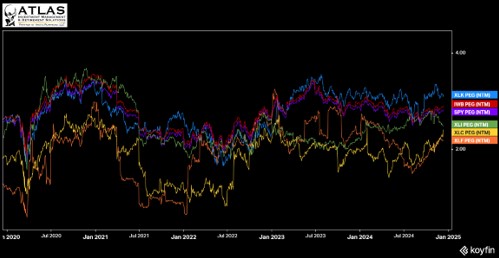

The chart above illustrates the evolution of Price/Earnings-to-Growth (PEG) ratios across several sectors, including technology (XLK), industrials (XLI), communications (XLC), and financials (XLF), alongside broad market indices such as the S&P 500 (SPY) and Russell 1000 (IWB). The higher PEG ratios for the technology and communication services sectors reflect their robust growth expectations, driven by innovation and the increasing adoption of artificial intelligence (AI). Notably, the sustained upward trend in PEG ratios for these sectors highlights market confidence in their ability to deliver future earnings growth, even as broader market indices exhibit steadier, more moderate trajectories.

This visualization underscores the disparity in valuation metrics between high-growth sectors and more traditional industries, illustrating how technology-driven companies command premium valuations due to their disruptive potential and scalability. The chart reinforces the argument that conventional valuation metrics, such as the Price/Earnings ratio, may inadequately capture the forward-looking value of companies pioneering technological advancements.

Traditional valuation metrics, such as price-to-earnings (P/E) ratios, require recalibration in technology-driven markets. Historically, an average P/E ratio of approximately 15x has been used as a benchmark for market valuations. However, in sectors like technology and AI, where growth potential and scalability significantly exceed historical norms, a higher average P/E ratio—closer to 20x or beyond—is increasingly justified. These elevated valuations reflect the market’s confidence in these companies’ ability to sustain innovation and achieve robust future earnings growth.

Additionally, as technology companies now constitute a significantly larger share of the overall market—both in terms of capitalization and contribution to economic growth—their higher justified valuations have begun to shift the baseline for the broader market. The historical market-wide P/E ratio, which was heavily influenced by traditional industries with slower growth rates, no longer fully reflects the composition of today’s market. The increasing dominance of technology and AI-driven companies suggests that the aggregate market P/E should be revised upward to account for these shifts.

This shift underscores the necessity of adopting forward-looking metrics like the Price/Earnings-to-Growth (PEG) ratio, which adjusts for growth rates and provides a more nuanced understanding of valuation dynamics. For instance, as seen in the accompanying PEG chart, the technology sector consistently demonstrates higher PEG ratios compared to traditional industries, aligning with its disproportionate contribution to market innovation and economic transformation. Forward-looking valuation models can capture the long-term value embedded in technological innovations, allowing investors to navigate these shifts more precisely.

By recognizing this recalibration of historical benchmarks, investors can more accurately assess opportunities within a market increasingly driven by high-growth sectors. Forward-looking valuation models can capture the long-term value embedded in technological innovations, allowing investors to navigate these shifts with greater precision.

The earnings landscape reflects a growing bifurcation across sectors. While technology companies consistently outperform due to robust innovation and demand, traditional industries face persistent headwinds arising from supply chain disruptions and shifting consumer preferences (FactSet, 2024). This divergence mirrors the adaptation required by hockey teams transitioning to a faster, more skill-oriented style of play, where traditional physical strategies are less effective.

Legacy industries must innovate to remain competitive, like hockey teams developing faster, more agile play styles. Tech sector resilience exemplifies the potential for industries prioritizing innovation to achieve sustained outperformance, reinforcing the importance of aligning investment strategies with long-term secular trends.

The ascendancy of the technology sector necessitates strategic portfolio realignment. Opportunities in cloud computing, AI-driven analytics, and enterprise software underscore the importance of identifying growth areas within the broader technological ecosystem (Goldman Sachs, 2024d). Successfully navigating this landscape demands rigorous research, adaptability, and a willingness to embrace calculated risks—qualities shared by modern hockey teams leveraging analytics to refine performance and gain competitive advantages.

Headline inflation, as measured by the Consumer Price Index (CPI), has moderated to 2.5% as of August 2024, alleviating some concerns about runaway price increases (Varghese, 2024b). However, core CPI—which excludes volatile food and energy components—remains elevated at 3.2%, driven primarily by shelter costs (JPMorgan Chase, 2024). This divergence highlights the complexity of navigating monetary policy in a multifaceted economic environment.

Policymakers must strike a delicate balance between fostering growth and containing inflation, akin to managing a hockey team’s energy levels across a demanding season. Early aggressive actions like rapid rate hikes resemble intensive early-season training. A more measured approach becomes necessary as conditions stabilize to maintain momentum and avoid exhaustion.

The Federal Reserve’s dual mandate—stabilizing inflation while maximizing employment—requires precision and adaptability. Recent labor market mismatches, where supply growth outpaces demand, underscore the fragility of the recovery (Goldman Sachs, 2024e). This dynamic is reminiscent of a hockey coach managing the ice time of star players, ensuring peak performance without overexertion.

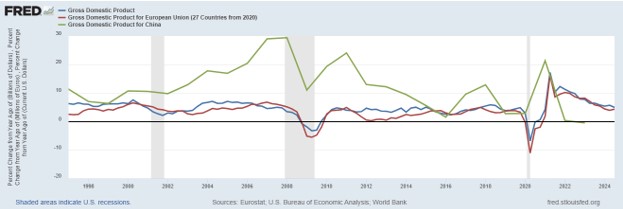

While the US economy demonstrates resilience, global growth trajectories reveal pronounced disparities. Structural challenges in Europe, coupled with China’s ongoing struggles with domestic demand and property sector issues, necessitate diversification strategies (Hatzius, 2024).

The chart illustrates the year-over-year percent change in Gross Domestic Product (GDP) for the United States, the European Union, and China. While the US economy exhibits relative stability, the European Union shows slower and more consistent growth, reflecting structural challenges and high inflation impacting consumer and business activity. In contrast, China’s GDP demonstrates greater volatility, with sharp peaks during periods of rapid expansion followed by pronounced slowdowns, such as the post-2020 deceleration due to property market challenges and weaker domestic demand. The divergence between these regions underscores the importance of diversification in global portfolios, as varying economic dynamics present distinct risks and opportunities. For instance, while China may offer high-growth potential, its volatility necessitates careful evaluation, whereas the US and EU provide steadier but potentially lower growth trajectories. This dynamic mirrors a hockey team’s need to adapt to different rink conditions and play styles, ensuring resilience across diverse environments.

Geopolitical tensions, especially those stemming from US-China trade disputes, have intensified uncertainty in global economic dynamics. These conflicts impact critical sectors such as semiconductors, high technology, and advanced manufacturing, which are highly interdependent on global supply chains. For instance, restrictions on semiconductor exports or disruptions in raw material supply chains can stifle innovation and production, particularly for industries reliant on these technologies, such as automotive, telecommunications, and consumer electronics. Such restrictions not only hinder the economic progress of the affected nations but also create ripple effects across the broader global economy by increasing costs, elongating lead times, and reducing supply chain resilience. Additionally, the growing trend of economic nationalism—where countries prioritize domestic production and self-reliance—has further complicated these dynamics, heightening the risk of fragmented global markets and reduced cross-border collaboration. Investors must carefully evaluate the implications of these geopolitical risks, as they can significantly influence the growth trajectories and valuation frameworks of companies within affected sectors (Goldman Sachs, 2024c).

Capitalizing on technological advancements requires more than just recognizing promising trends; it demands a deep, incisive understanding of how these trends are likely to evolve and reshape industries. Identifying opportunities in areas like artificial intelligence, cloud computing, or advanced manufacturing is only the starting point. Investors must also assess the broader ecosystem that supports these innovations, including supply chain robustness, scalability, and alignment with regulatory frameworks. For instance, a cutting-edge AI company may show strong growth potential, but its success could hinge on access to high-quality semiconductors, partnerships with key industry players, or compliance with evolving data privacy regulations.

This process parallels the scouting and development of high-potential hockey players, where identifying raw talent is critical but insufficient on its own. Success in hockey also depends on nurturing that talent within a supportive environment—providing advanced training facilities, a cohesive team culture, and strategic mentorship. Similarly, understanding the interplay of market dynamics, competitive positioning, and long-term scalability in investing ensures that potential opportunities can be transformed into sustainable returns. By integrating these layers of analysis, investors can confidently embrace calculated risks, positioning themselves to capitalize on transformational growth while mitigating associated uncertainties.

Adequate diversification—spreading investments across various sectors, geographies, and asset classes—continues to be a foundational principle of sound investment strategies. By allocating assets among different industries, regions, and types of investments, portfolio managers can reduce exposure to the risks associated with any single economic event or market downturn. For example, while equities may deliver high growth potential, their inherent volatility can be balanced by including bonds, real estate, or commodities, which tend to behave differently under varying market conditions.

Alternative investments, such as real estate and commodities, play a particularly vital role in this diversification process. Real estate often serves as a tangible asset class with the potential for steady income and appreciation, while commodities like gold or oil can act as hedges against inflation or economic instability. Together, these alternatives enhance a portfolio’s overall stability by reducing its correlation to traditional equities and bonds. This dynamic mirrors the role of a strong defensive lineup in hockey. Just as a solid defense can shield a team from the pressures of relentless offense and ensure resilience during challenging plays, these alternative investments provide the durability needed to navigate periods of market volatility and sustain long-term performance.

By maintaining a well-diversified portfolio, investors are better equipped to weather short-term fluctuations and achieve consistent returns, even as markets evolve and economic landscapes shift. Diversification is not just a defensive strategy but a proactive approach to creating balance and capturing opportunities across an increasingly complex and interconnected global economy.

Navigating the complexities of an evolving economic landscape requires intellectual agility, strategic foresight, and a commitment to continuous adaptation. By embracing technological innovation, recalibrating traditional valuation models, and maintaining diversified portfolios, investors can position themselves to thrive amid uncertainty. As in hockey, success depends on a disciplined synthesis of skill, strategy, and resilience—ensuring readiness to capitalize on emerging opportunities while withstanding challenges.

FactSet. (2024). Earnings Insight Report. Retrieved from https://www.factset.com/reports/earningsinsight

Gilbert, B. (2024). Doomsayers have their new indicator: The yield curve uninverts. Carson Group. Retrieved from https://www.carsongroup.com/insights/blog/doomsayers-have-their-new-indicator-the-yield-curve-uninverts/

Goldman Sachs. (2024a). Fed Chatterbox September Edition. Retrieved from https://www.gs.com/research/hedge.html

Goldman Sachs. (2024b). Global views: Controlled descent. Retrieved from https://research.gs.com/

Goldman Sachs. (2024c). The potential impact of a significant rate cut. Retrieved from https://www.gs.com/research/hedge.html

Goldman Sachs. (2024d). Takeaways from our Silicon Value AI Field Trip. Retrieved from https://www.gs.com/research/hedge.html

Goldman Sachs. (2024e). The Demand Side of the Labor Market. Retrieved from https://research.gs.com

Hatzius, J. (2024). Global views: Controlled descent. Goldman Sachs Global Investment Research. Retrieved from https://research.gs.com/

Huang, J. (2024). Nvidia Corp. CommunicAsia Technology Conference 2024 — Key Takeaways. Nvidia Corporation.

JPMorgan Chase. (2024). US: CPI beat on firmer shelter costs, and core PCE is likely softer. Retrieved from https://www.jpmorganmarkets.com

Varghese, S. (2024a). The Fed’s got the back of the labor market. Carson Group. Retrieved from https://www.carsongroup.com/insights/blog/the-feds-got-the-back-of-the-labor-market/

Varghese, S. (2024b). The inflation fight is over, but Fed policy remains uncertain. Carson Group. Retrieved from https://www.carsongroup.com/insights/blog/the-inflation-fight-is-over-but-fed-policy-remains-uncertain/

Disclaimer: Securities are offered through Purshe Kaplan Sterling Investments, Member FINRA/SPIC headquartered at 80 State Street, Albany, NY 12207. Investment Advisory Services offered through PWW LLC, an SEC Registered Investment Adviser. Investment Advisory services are provided through Ignite Planners, LLC. Purshe Kaplan Sterling Investments and Ignite Planners, LLC are not affiliated companies. Ignite Planners, LLC only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission and does not imply that the advisor has achieved a particular level of skill or ability. All investment strategies have the potential for profit or loss.

The information presented is believed to be current. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the presenter on the date of the presentation and are subject to change. All investment strategies have the potential for profit or loss. Asset allocation and diversification will not necessarily improve an investor’s returns and cannot eliminate the risk of investment losses. Target allocations can deviate at any given time due to market conditions and other factors. There can be no guarantee that an investment or strategy will be suitable or profitable for an investor’s portfolio. Different types of investments involve higher and lower levels of risk.

Charts and slides do not represent the performance of Atlas Investment Management or any of its advisory clients. Historical performance returns for investment indexes and/or categories usually do not deduct transaction and/or custodial charges or an advisory fee, which would decrease historical performance results. There are no guarantees that an investor’s portfolio will match or outperform a specific benchmark.

This communication, including attachments, is for the exclusive use of the addressee and may contain proprietary, confidential, or privileged information. If you are not the intended recipient, any use, copying, disclosure, dissemination, or distribution is strictly prohibited. Please notify the sender immediately by return email, delete this communication, and destroy all copies.