“In investing, what is comfortable is rarely profitable.”

–Robert Arnott, American Businessman & Investor

Volume 16

Under the Hood of US Economic Resilience

What Happened in the Markets

Subscribe and start receiving the Atlas Memo directly to your email

As many of you are aware, Atlas has recently relocated offices—a thrilling development for all of us here! This significant move, along with the inherent challenges and surprises it brought, served as a perfect metaphor for the recent trajectory of the US economy. Imagine this: It’s moving day, and despite some mishaps like broken boxes and late movers, you stumble upon hidden treasures and extra cash you had forgotten about. That’s quite similar to the US economy’s showing in the first quarter. At first blush, the modest 1.6% GDP growth might lead you to think the economic moving van struggled to get rolling. Yet, a deeper inspection of our ‘boxes’—namely consumer spending and business investment—shows not just resilience but flourishing vitality, reminding us that the true success of a move isn’t just in how it starts but in the treasures uncovered along the way.

Despite the modest headline GDP growth of 1.6% in the first quarter, a closer examination of the economic data reveals a robust undercurrent of strength, particularly in consumer spending and business investment. This is a testament to the US economy’s resilience and its ability to thrive even in the face of challenges like

higher interest rates and inflationary pressures.

The US economy’s mainstay, consumer spending, continues to demonstrate its resilience. Services spending, which accounts for a significant 45% of the economy, surged at an annualized pace of 4%—a figure that surpasses the pre-pandemic trend. This increase is not a temporary boost but a reflection of solid household inances. With disposable incomes growing at 4.8% and employee compensation up by 7.3%, American consumers have more than kept pace with inflation, indicating a strong and stable consumer base.

Inflation remains a concern, with the annual personal consumption expenditures index rising at 4.4% in Q1. However, the bigger picture reveals income growth outstripping inflation. Notably, average hourly wages, particularly for non-managers, have risen faster than inflation, providing more disposable income for everyday Americans.

Another pillar of economic strength is the robust state of household balance sheets. The net worth of American households is significantly above historical levels, standing at 736% of disposable incomes. This financial health has understandably led to a decrease in the savings rate as households feel wealthier and more secure in their financial positions.

Despite the abundance of wealth, American households’ debt levels have remained well managed, as we presented in a previous month’s Memo. Liabilities—which include mortgage and personal loans—have not increased significantly, keeping household debt service payments at a reasonable 9.8% of disposable income. This percentage is below both pre-pandemic and historical averages. The fiscal prudence displayed by households across all income levels emphasizes a less leveraged and more resilient consumer base.

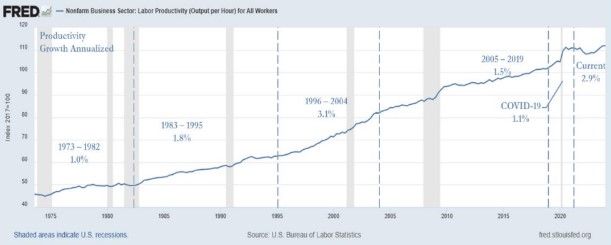

The labor market continues to play a vital role in supporting the economy. In the first quarter, payroll growth averaged 266,000, and the unemployment rate remained consistently below 4%, indicating a strong labor force. This robust labor market strength increases consumer confidence and spending, further driving economic activity. According to our 2024 Outlook, we may see a resurgence in productivity growth, as shown by the Nonfarm Business Sector Labor Productivity Index below. Productivity has risen by 2.9% in the last year, significantly higher than the 1.1% annualized pace recorded between the first quarter of 2020 and the first quarter of 2023 or the 1.5% annual pace recorded between 2005 and 2019.

While the initial GDP figures for the first quarter might seem underwhelming, the real story lies in the underlying components of this growth. Setting aside volatile elements like private inventories and net exports, real final demand in the economy rose by 2.8%. This robust indicator of underlying economic activity suggests a strong foundation that’s likely to support sustained growth. It reflects healthy engagement from consumers and businesses, pointing towards an economy that is not just stable but poised for further expansion despite the modest headline numbers.

The Federal Reserve’s current approach reflects its cautious optimism. Despite inflation being above target, the Fed has opted to maintain policy rates, indicating its watchful approach toward future rate cuts. Such a prudent monetary policy is designed to foster economic stability while also allowing for better control over inflation. This approach is bound to yield positive results in the long run and ensure a sustainable economic future.

As we finish unpacking the economic indicators from the first quarter, it’s clear that the outside of the boxes might have looked a bit battered. Still, the contents inside were surprisingly resilient and valuable. Much like finally settling into a new home after a chaotic move, the US economy neatly arranges its strong fundamentals—robust consumer spending, solid labor markets, and sturdy financial footing—making it well prepared to decorate its future with growth and stability. The initial curb appeal of the GDP growth rate may not have drawn oohs and aahs, but the foundation and structure are stronger than they appear, ready to support sustained economic prosperity.

April proved to be a challenging month for the markets. The S&P 500 experienced a 4.1% decline, leaving its year-to-date (YTD) return at 6.0%. Small caps faced even steeper losses, down 7.0%, which brought their YTD return to -2.2%.

Internationally, performance was relatively better, though still negative; developed markets fell by 1.7% and emerging markets slightly by 0.2%, resulting in YTD returns of 3.0% and 2.0%, respectively. This suggests a potential for recovery in the coming

months.

These downturns were primarily driven by higher-than-expected

inflation figures, geopolitical uncertainties, and other global concerns that prompted a shift towards safer assets throughout the

month. Despite these trends, we consider the move towards risk

aversion to be premature.

The fixed income sector also encountered difficulties. US Treasuries and the Aggregate Bond Market decreased by 2.2% and 2.4%, respectively, while high yields dipped by 1.0%. In contrast, bank loans managed a positive gain, ending the month up by 56 basis points (0.56%).

Looking at the first four months of 2024, fixed income results were

mixed: Treasuries and the Aggregate market are down by 3.1% and 3.2%, respectively, whereas bank loans and high yields have posted returns of 2.3% and 10 basis points.

We’re monitoring the market and adapting to navigate tough times.

With geopolitical tensions and inflation, diversification is key. We’re prepared to handle these challenges.

As the Chief Investment Officer, Stephen Swensen oversees investment management, research, portfolio design, and all investment-related operations at Atlas. He also chairs the Atlas Investment Committee, guiding strategic investment decisions.

Stephen’s career began as a Financial Analyst for Deseret Mutual Benefits Administration (DMBA), a role in which he managed investments for a private pension fund and insurance company. Subsequently, he served as an investment analyst and portfolio manager for local Registered Investment Advisors (RIAs). Before joining Atlas, Stephen contributed his expertise as an Outsourced Chief Investment Officer (OCIO) for the Carson Group, supporting advisors on the West Coast. Educationally, Stephen holds an MBA and an MS in Investment Management and Financial Analysis from Creighton University. He has earned the Series 65 Uniform Investment Advisor License and is actively pursuing the prestigious

Chartered Financial Analyst (CFA) designation.

Beyond his professional achievements, Stephen is an enthusiastic hockey fan, both on and off the ice. He finds joy in playing the piano, golfing, reading, and outdoor cooking. However, his greatest source of happiness comes from spending quality time with his wife and four children

NOTICE REGARDING INVESTMENT DISCLOSURES: The contents of this memo reflect the opinions of the author(s) as of the indicated date and are subject to change without notice. Atlas Investment Management has no obligation to update the information provided here. It should not be assumed that past investment performance guarantees future results. Potential for profit also entails the risk of loss.

The information presented is believed to be current and is not personalized investment advice. All opinions expressed are as of the date of the presentation and may change over time. All investment strategies carry the potential for profit or loss. Asset allocation and diversification cannot guarantee improved returns or eliminate the risk of investment losses. Target allocations may deviate due to market conditions and other factors. There is no guarantee that any investment or strategy will be suitable or profitable for an investor’s portfolio. Different types of investments involve varying levels of risk.

The charts and slides do not depict the performance of Atlas Investment Management or any of its advisory clients. Historical performance returns for investment indexes and/or categories typically do not factor in transaction and/or custodial charges or an advisory fee, which may decrease historical performance results. There is no assurance that an investor’s portfolio will match or exceed a specific benchmark.

This communication, including any attachments, is intended exclusively for the addressee and may contain proprietary, confidential, or privileged information. Unauthorized use, copying, disclosure, dissemination, or distribution is strictly prohibited. If you are not the intended recipient, please immediately notify the sender by return email, delete this communication, and destroy all copies.

Securities are offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC, headquartered at 80 State Street, Albany, NY 12207. Investment Advisory services are offered through Ignite Planners, LLC. Purshe Kaplan Sterling Investments and Ignite Planners, LLC are not affiliated companies. Ignite Planners, LLC conducts business only in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission and does not imply that the advisor has achieved a particular level of skill or ability. All investment strategies carry the potential for profit or loss.