“A river cuts through rock, not because of its power, but because of its persistence.”

–Attributed to Miyamoto Musashi (c. 1584–1645)

Volume 22

Beyond the Ballot: Why the Economy, Not the Election, Holds the Key to Market Growth

What Happened in the Markets

Subscribe and start receiving the Atlas Memo directly to your email

As another Election Day fades into the rearview, it’s tempting to picture markets on edge, bracing for impact with each ballot counted. But while the suspense is real, the economic story suggests a calmer narrative. Investors have learned that the most significant market movers aren’t red or blue ties but the green lights of economic fundamentals like GDP, consumer spending, and interest rates. This month’s memo dives into how the economy—not just election outcomes—mainly determines market direction.

Many assume the election alone can dictate market fate, but history tells a more nuanced story. Volatility tends to spike as uncertainty rises, and the VIX—the “fear gauge” of the market—has seen some elevation in recent months. Interestingly, this is less about outright fear and more about cautious hedging from investors uncertain of the short-term. This hedging creates volatility, yet it doesn’t necessarily spell downturns. In fact, markets tend to follow a robust three-month rally post-election. Average gains in November through January stand at around 4%, with an additional 5.3% over six months, regardless of who takes office.

Take the 2020 election, where uncertainty lingered for a few extra days. Stocks actually rose by over 4% during that time, indicating that markets have a way of seeing beyond the temporary. Another example: in 2000, when the election extended until December with the Supreme Court’s intervention, markets maintained steadiness. The narrative remains consistent: temporary election drama is rarely enough to shake the market’s long-term confidence. History is on the side of a post-election rally, grounded in fundamentals rather than political affiliation.

Market volatility often stirs unease among investors, yet this year’s election-related fluctuations could signal opportunity rather than risk. Currently, the VIX—widely known as the “fear gauge”—is elevated as investors use options to hedge against short-term uncertainty. This may seem counterintuitive, given that markets are otherwise in a rally. However, while temporarily boosting volatility, these hedges tend to unwind after the election, setting the stage for gains.

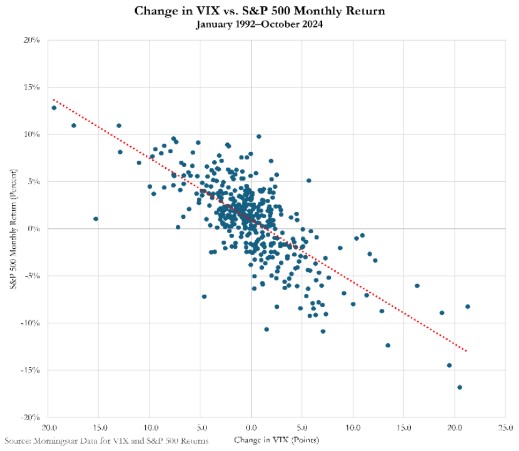

When VIX levels fall after an event like the election, historical data show an inverse relationship with the S&P 500: lower volatility often aligns with higher returns. The scatterplot below highlights that when the VIX decreases by more than 5 points in a month, the S&P 500 gains an average of 6%. Smaller drops in volatility also correspond with positive returns, averaging 2.8% when the VIX dips by 2–5 points. This suggests that as post-election uncertainty fades and VIX levels fall, markets gain traction, creating favorable conditions for a rally.

In short, while election fears may have spiked volatility, unwinding these hedges could act as a tailwind, potentially pushing the market higher as the election results come into focus.

Once the election settles, the unwinding of these option-based hedges often triggers market momentum. Here’s how it works: when hedges are removed, options sellers—typically dealers—reduce their market exposure by buying back stocks, which raises prices. This inverse relationship between volatility and the S&P 500 could create the perfect conditions for a rally as volatility drops. Again, to reiterate, historically, whenever the VIX falls by more than 5 points in a single month, the S&P 500 has gained an impressive average of 6%. Even smaller drops in the VIX (between 2 and 5 points) result in an average gain of 2.8%.

The idea of “fear” in the market, represented by volatility, may be less about actual economic risk and more about investors taking out a temporary insurance policy. As these options expire or roll off post-election, we may see this “fear gauge” lower, allowing for more upside potential in the market.

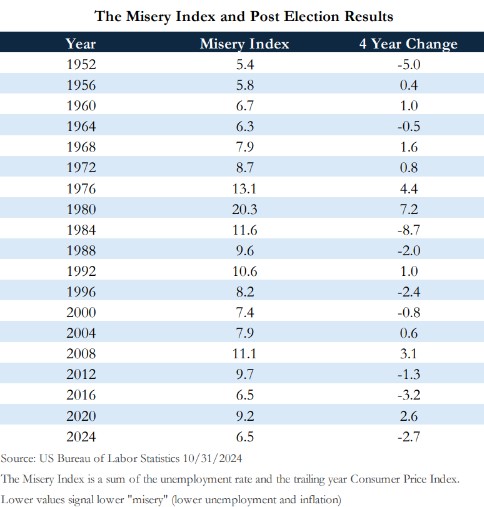

Elections may grab the headlines, but the real driver of long-term market performance is economic stability. Key indicators like employment rates, inflation, and consumer sentiment consistently influence investor confidence far more than any single political outcome. One helpful metric for assessing economic conditions is the Misery Index, which combines the unemployment and inflation rates to gauge consumers’ overall financial strain. Lower values in the Misery Index suggest a healthier economic environment, as they reflect lower inflation and higher employment, both of which encourage consumer spending and market growth.

This year’s Misery Index sits impressively low, ranking in the 20th percentile of all election-year readings since 1952. This low level suggests a stable economic foundation, with steady job growth and moderated inflation—a setup that markets historically respond to with optimism.

The chart to the right illustrates the Misery Index across election years, emphasizing where today’s level stands relative to historical values. Markets generally see positive trends when the Misery Index is low, as stable employment and controlled inflation boost consumer confidence. Historically, low Misery Index values correlate with favorable market outcomes, reinforcing the idea that a resilient economy is more critical to market performance than political outcomes.

October unfolded as a volatile month, just as we anticipated, marking it as the second-worst month for markets this year— only better than April. Heightened uncertainty surrounding the presidential election contributed to increased market volatility.

Equity indexes tracked were all down in October. The S&P 500 declined by -0.9%, with small caps down -1.4%. International markets underperformed compared to domestic, with developed markets down -4.7% and emerging markets down -3.6%.

The one bright spot in fixed income was bank loans, which returned a positive 1.0%. However, US Treasuries, the US Aggregate Bond Index, and high-yield bonds recorded losses of -2.4%, -2.5%, and -0.6%, respectively.

As discussed in this month’s article, we expect November and December to return to the positive trends seen for much of 2024. With election related uncertainty likely to subside, the market’s focus will shift to more significant economic indicators.

The current economic climate, characterized by low unemployment and manageable inflation, fosters a favorable market environment, regardless of election outcomes. While political changes can influence policy, strong fundamentals will drive market growth into 2025.

Elections often bring market anxiety, but data show that market reactions are generally brief and follow a pattern of recovery. Looking back at elections like those in 2008 or 2020—years marked by major economic downturns—markets declined post election primarily due to recessionary conditions rather than the political result itself. When we exclude recession-driven elections, the average three-month return rises to 5.7% and the six-month return to 7.4%, reflecting markets’ confidence when economic fundamentals are sound.

History shows that close elections, even those settled by narrow margins, rarely disrupt markets in the long run. When the economy is strong, markets often ignore election uncertainties. Moreover, significant geopolitical events typically do not influence long-term market trends as much as factors like employment, inflation rates, and global economic conditions.

Looking forward, the stage appears set for a solid finish to 2024. The economic fundamentals are in place—employment remains stable, inflation has moderated, and the Federal Reserve has adopted a rate-cutting posture that supports business growth. The current momentum in the market, combined with seasonal strength from November to January, hints that this year could conclude with gains similar to historical averages. Analysts note that as option hedges unwind, there’s likely to be a positive market push, particularly if volatility subsides post-election.

“Momentum begets momentum.” The S&P 500 has performed well this year, and historical trends show that such rallies oftenlead to further gains. The current economic landscape, free from recession fears typical of past election years, suggests a positive market trajectory. While political outcomes can temporarily impact specific sectors, the overall economy has a greater influence on the broader market. Investors should prioritize these fundamentals over political narratives in shaping their financial outlook.

As election dust settles, the market will likely look toward 2025 with renewed optimism, powered by an economy that’s doing its part to support growth. Temporary volatility around election results may create the usual chatter, but the economic fundamentals always have the final say. This year’s election may generate drama, but critical market drivers like employment, consumer spending, and corporate earnings will likely keep things steady. As we enter the last months of 2024, it’s essential to remember that while elections influence the market, the economy ultimately rules it. With solid fundamentals in place, we have reason to be optimistic about what lies ahead.

As the Chief Investment Officer, Stephen Swensen oversees investment management, research, portfolio design, and all investment-related operations at Atlas. He also chairs the Atlas Investment Committee, guiding strategic investment decisions.

Stephen’s career began as a Financial Analyst for Deseret Mutual Benefits Administration (DMBA), a role in which he managed investments for a private pension fund and insurance company. Subsequently, he served as an investment analyst and portfolio manager for local Registered Investment Advisors (RIAs). Before joining Atlas, Stephen contributed his expertise as an Outsourced Chief Investment Officer (OCIO) for the Carson Group, supporting advisors on the West Coast. Educationally, Stephen holds an MBA and an MS in Investment Management and Financial Analysis from Creighton University. He has earned the Series 65 Uniform Investment Advisor License and is actively pursuing the prestigious

Chartered Financial Analyst (CFA) designation.

Beyond his professional achievements, Stephen is an enthusiastic hockey fan, both on and off the ice. He finds joy in playing the piano, golfing, reading, and outdoor cooking. However, his greatest source of happiness comes from spending quality time with his wife and four children

NOTICE REGARDING INVESTMENT DISCLOSURES: The contents of this memo reflect the opinions of the author(s) as of the indicated date and are subject to change without notice. Atlas Investment Management has no obligation to update the information provided here. It should not be assumed that past investment performance guarantees future results. Potential for profit also entails the risk of loss.

The information presented is believed to be current and is not personalized investment advice. All opinions expressed are as of the date of the presentation and may change over time. All investment strategies carry the potential for profit or loss. Asset allocation and diversification cannot guarantee improved returns or eliminate the risk of investment losses. Target allocations may deviate due to market conditions and other factors. There is no guarantee that any investment or strategy will be suitable or profitable for an investor’s portfolio. Different types of investments involve varying levels of risk.

The charts and slides do not depict the performance of Atlas Investment Management or any of its advisory clients. Historical performance returns for investment indexes and/or categories typically do not factor in transaction and/or custodial charges or an advisory fee, which may decrease historical performance results. There is no assurance that an investor’s portfolio will match or exceed a specific benchmark.

This communication, including any attachments, is intended exclusively for the addressee and may contain proprietary, confidential, or privileged information. Unauthorized use, copying, disclosure, dissemination, or distribution is strictly prohibited. If you are not the intended recipient, please immediately notify the sender by return email, delete this communication, and destroy all copies.

Securities are offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC, headquartered at 80 State Street, Albany, NY 12207. Investment Advisory services are offered through Ignite Planners, LLC. Purshe Kaplan Sterling Investments and Ignite Planners, LLC are not affiliated companies. Ignite Planners, LLC conducts business only in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission and does not imply that the advisor has achieved a particular level of skill or ability. All investment strategies carry the potential for profit or loss.