“Nothing can stop the [person] with the right mental attitude from achieving [their] goal; nothing on earth can help the [person] with the wrong attitude.”

–Thomas Jefferson, Third President of the United States

Volume 20

Market Power Plays: How Perseverance Drives Wins

What Happened in the Markets

Subscribe and start receiving the Atlas Memo directly to your email

Last month, we talked about how uncertainty is the only certainty. This month let’s pivot to something equally important: perseverance. It’s the secret sauce that helps us navigate through the twists and turns of uncertainty.

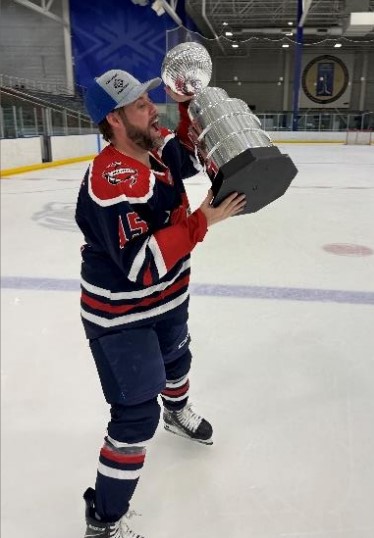

Now, let me take you to the ice rink for a moment. As some of you might know, I’m a diehard hockey fan—so much so that I’m beyond excited about the NHL coming to Utah. You’ll definitely catch me at several games! I’m also in an adult hockey league, and we recently wrapped up our season with a dramatic playoff run. Our journey took us all the way to the championship game, facing off against the league’s top team—a squad that had impressively gone undefeated all season.

This wasn’t just any game; the stakes were high, and the tension was palpable. After a scoreless first period, our opponents broke the deadlock in the second, leaving us trailing 1–0. It was a tough spot, and we knew we had an uphill battle. But giving up wasn’t an option. Heading into the third period, we focused on what we needed to do. Even though it felt like we were controlling the game, their goalie seemed impossible to beat. But with just five minutes left on the clock, our perseverance paid off—we finally found the back of the net to tie the game. The momentum shifted, and with about 90 seconds remaining, we scored again. Our opponents pulled their goalie in a last-ditch effort, but we held firm and even added an empty netter in the final seconds. What began as a 1–0 deficit ended in a 3–1 victory, and we proudly hoisted our hard-earned trophy.

So why share this hockey tale? Because the financial markets can feel a lot like that championship game. August was a perfect example, with the stock market experiencing significant ups and downs due to concerns over the Japanese market and weaker-thanexpected US labor data. The S&P 500 took a sharp dive at the start of the month, sparking media chatter about a looming recession. But much like in our game, the tide turned. By the end of the month, the market had bounced back, finishing up 2.4% after being down more than 8% from its peak in July.

The takeaway? A few rough days don’t mean the game is over. The market, much like a determined hockey team, has a knack for bouncing back. Keeping this in mind can help us stay calm when things get tough—because, in the end, perseverance pays off.

We see a pattern of ebbs and flows when we zoom out and look at the market over a longer time horizon. A J.P. Morgan Asset Management chart (below) wonderfully illustrates this point. By focusing on a single asset class, we notice how its performance can swing dramatically from year to year. Take small-cap stocks, for example. In 2010, they were the second-best performer, but by the end of 2011, they had plummeted to the bottom 30th percentile. Cash is another extreme case; it’s usually one of the worst-performing asset classes, yet from 2017 to 2018, it jumped from the worst to the best. Trying to predict when certain asset classes will shine is an extremely difficult—if not impossible—task.

This is where diversification and persistence come into play. The chart’s “Asset Allocation” box represents a well-diversified portfolio—indicated by a 60/40 mix of stocks and bonds—showing that while it may never be the top performer, it never hits rock bottom either. This consistency underscores the importance of a diversified portfolio aligning with your risk tolerance. It allows us to weather the market’s ups and downs, providing steady and less volatile returns. In short, perseverance—whether on the ice or in the market—combined with a solid strategy is key to winning.

Despite early concerns, the S&P 500 finished August with a 2.4% gain, just 33 basis points shy of July’s peak, bringing the year-to-date return to 19.5%. Small caps struggled, declining 1.5% for the month but remaining up 10.4% YTD. International markets performed well, with developed markets gaining 2.8% (11.5% YTD) and emerging markets up 1.0% (8.7% YTD).

Fixed income saw strong performance amid anticipation of rate cuts. US Treasuries returned 1.3% (2.8% YTD), and the US Aggregate Bond Index rose 1.4% (3.2% YTD). Bank loans added 0.8% (5.2%

YTD), and high-yield bonds increased by 1.5% (5.9% YTD). Overall, all markets have posted gains through the first eight months of the year.

As the Chief Investment Officer, Stephen Swensen oversees investment management, research, portfolio design, and all investment-related operations at Atlas. He also chairs the Atlas Investment Committee, guiding strategic investment decisions.

Stephen’s career began as a Financial Analyst for Deseret Mutual Benefits Administration (DMBA), a role in which he managed investments for a private pension fund and insurance company. Subsequently, he served as an investment analyst and portfolio manager for local Registered Investment Advisors (RIAs). Before joining Atlas, Stephen contributed his expertise as an Outsourced Chief Investment Officer (OCIO) for the Carson Group, supporting advisors on the West Coast. Educationally, Stephen holds an MBA and an MS in Investment Management and Financial Analysis from Creighton University. He has earned the Series 65 Uniform Investment Advisor License and is actively pursuing the prestigious

Chartered Financial Analyst (CFA) designation.

Beyond his professional achievements, Stephen is an enthusiastic hockey fan, both on and off the ice. He finds joy in playing the piano, golfing, reading, and outdoor cooking. However, his greatest source of happiness comes from spending quality time with his wife and four children

NOTICE REGARDING INVESTMENT DISCLOSURES: The contents of this memo reflect the opinions of the author(s) as of the indicated date and are subject to change without notice. Atlas Investment Management has no obligation to update the information provided here. It should not be assumed that past investment performance guarantees future results. Potential for profit also entails the risk of loss.

The information presented is believed to be current and is not personalized investment advice. All opinions expressed are as of the date of the presentation and may change over time. All investment strategies carry the potential for profit or loss. Asset allocation and diversification cannot guarantee improved returns or eliminate the risk of investment losses. Target allocations may deviate due to market conditions and other factors. There is no guarantee that any investment or strategy will be suitable or profitable for an investor’s portfolio. Different types of investments involve varying levels of risk.

The charts and slides do not depict the performance of Atlas Investment Management or any of its advisory clients. Historical performance returns for investment indexes and/or categories typically do not factor in transaction and/or custodial charges or an advisory fee, which may decrease historical performance results. There is no assurance that an investor’s portfolio will match or exceed a specific benchmark.

This communication, including any attachments, is intended exclusively for the addressee and may contain proprietary, confidential, or privileged information. Unauthorized use, copying, disclosure, dissemination, or distribution is strictly prohibited. If you are not the intended recipient, please immediately notify the sender by return email, delete this communication, and destroy all copies.

Securities are offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC, headquartered at 80 State Street, Albany, NY 12207. Investment Advisory services are offered through Ignite Planners, LLC. Purshe Kaplan Sterling Investments and Ignite Planners, LLC are not affiliated companies. Ignite Planners, LLC conducts business only in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission and does not imply that the advisor has achieved a particular level of skill or ability. All investment strategies carry the potential for profit or loss.