“We have two kinds of forecasters, the ones who don’t know and the ones

who don’t know they don’t know.”

–John Kenneth Galbraith, American Economics (1908–2006)

Volume 24

Atlas 2025 Market Outlook

What Happened in 2024: A Market Recap

Subscribe and start receiving the Atlas Memo directly to your email

As we look ahead to what 2025 might bring, predicting the economy for the upcoming year is indeed challenging, and we will certainly not get it entirely right. While we can utilize the tools at our disposal to generate our best-educated estimates, we will never achieve absolute accuracy—much like the quote from Mr. Galbraith suggests. For example, in 2024, we anticipated moderate low-double-digit growth across markets, yet those markets proved extraordinarily resilient, performing twice as well as we expected. As we consider 2025, here is our best attempt at forecasting what could happen throughout the year.

Let’s imagine our quests as if embarking on a journey across a vast, foggy ocean guided only by the light of a distant lighthouse. For investors, 2025 presents a similar scenario—a mix of clear opportunities and hidden challenges. The US economy resembles a sturdy ship navigating through global economic shifts bolstered by steady growth, adaptive monetary policy, and emerging investment trends. However, this adaptability must also face the risks of potential policy missteps, particularly as the Federal Reserve tries to balance inflation control with economic expansion. Much like navigating our ocean voyage, the path forward requires careful consideration, as uncertainties in global markets and policy decisions could create potential storms or turbulent waters.

2025 begins with a positive outlook, buoyed by strong economic fundamentals. GDP growth is forecasted to exceed expectations, with the US economy projected to expand by 2.4% year-over-year. This growth is driven by robust consumer spending, which continues to serve as the backbone of the economy, and a surge in investments related to artificial intelligence (AI) technologies. These technologies are transforming industries and redefining competitive advantages across the global landscape.

Inflation, a concern that dominated recent years, is expected to approach the Fed’s target of 2%. While this signals progress, new policies, such as tariff adjustments that may introduce temporary price fluctuations, particularly in sectors sensitive to import costs. The labor market, which has shown resilience, is likely to remain a key contributor to economic stability—with wage growth supporting consumer confidence.

The equity market is set for a solid year, with the S&P 500 anticipated to achieve earnings growth of 14.8%. All sectors are expected to contribute positively, reflecting broad-based economic strength. Valuations, while elevated, are supported by reduced corporate leverage and improved profitability metrics, providing a solid foundation for investor confidence.

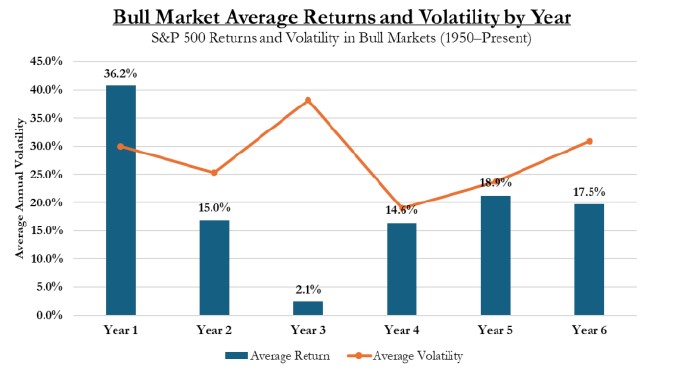

However, the current market environment bears a resemblance to other third-year bull markets, historically characterized by positive gains but also heightened volatility, as shown in the chart and discussed in last month’s memo. Factors such as elevated valuations and shifting monetary policies create conditions ripe for market fluctuations, particularly as the Fed seeks to balance its inflation target with broader economic growth goals. This

delicate equilibrium underscores the potential for policy missteps to amplify market volatility. With the Fed walking a fine line between taming inflation and fostering growth, any misstep—whether tightening too aggressively or easing prematurely— could exacerbate market instability.

We’ll continue to be mindful of broader economic cycles and stay disciplined in our strategies. Historical patterns show that diversification, a long-term perspective, and avoiding emotional reactions to short-term market movements are critical. These principles are especially important in a year when unexpected monetary policy shifts or geopolitical tensions could create sudden volatility. Nevertheless, the structural underpinnings of this market—including advancements in AI, deregulation, and robust earnings growth—signal that this bull market remains alive and well.

Key investment themes for 2025 include greater differentiation across sectors, styles, and regions. Companies at the forefront of technological innovation, particularly in AI, are likely to see outsized gains as these advancements redefine industries. Deregulation in specific industries further amplifies the potential for growth, particularly in technology and energy sectors. Mid-cap and small-cap stocks, which demonstrated resilience in late 2024, are positioned to close the valuation gap with their large-cap counterparts, offering additional opportunities for investors.

In contrast to equities, the fixed income market presents a more complex landscape. While persistent inflation risks and tight credit spreads pose challenges, the broader trajectory toward inflation nearing the Fed’s target of 2% provides a more optimistic backdrop for fixed income investments. Treasury yields, which could rise beyond 5% if inflation proves sticky, pose challenges for longer-duration bonds. Investors in this space may face a dual dilemma of balancing yield expectations with duration risks.

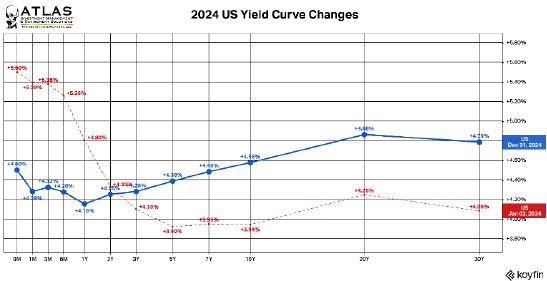

To highlight the shifts in interest rate expectations, a comparison of the Treasury yield curve between January and December 2024 illustrates the market’s response to evolving inflation trends and monetary policy adjustments. The uninverting of the curve during this period underscores the dynamics of investor sentiment and central bank actions, providing critical context for evaluating bond strategies in 2025.

That said, opportunities do exist. Shorter-duration assets and high-quality corporate bonds are likely to be more resilient, providing safer options for risk-averse investors. Additionally, municipal bonds may become more appealing due to favorable tax treatments and stable credit conditions—especially during broader market volatility.

The markets in 2024 delivered a strong performance, overcoming earlier concerns about persistent inflation and geopolitical challenges. US equities showcased remarkable strength, fueled by robust corporate earnings in the technology and consumer sectors, alongside sustained innovation in AI and green energy industries. The S&P 500 surged with a total return of 25.0%, outperforming all major indices, while small-cap stocks generated a solid return of 11.5%.

Emerging markets had mixed results. Commodity-exporting countries thrived, while others faced challenges from currency depreciation and geopolitical instability. Overall, the segment ended the year with a 6.9% gain.

Global markets regained momentum, particularly in Europe

and Asia, where manufacturing recoveries and stronger consumer spending drove indices higher. Developed markets demonstrated relative stability, posting a 7.6%

return for the year.

Fixed income markets have adapted to a “higher-for-longer” interest rate environment, attracting cautious investors with appealing yields. US Treasuries returned 0.7%, and the Aggregate Bond Index returned 1.4%. Higher-risk segments like bank loans and highyield bonds stood out with returns of 8.2% and 7.7%, respectively.

In 2024, the importance of maintaining a long-term

perspective amidst market noise became evident, highlighting the benefits of disciplined investment strategies.

The alternative investment space is poised for significant interest in 2025, though our stance on Bitcoin remains highly cautious. While its climb to $100,000 in late 2024 has captured much attention, Bitcoin is inherently speculative and characterized by extreme volatility. At Atlas, we maintain a minimal position in Bitcoin, viewing it primarily as an experimental allocation rather than a core portfolio component. Its low correlation with traditional asset classes does offer diversification benefits, but disciplined and limited exposure is essential to mitigate risks. However, its inherent volatility underscores the importance of disciplined allocation strategies.

In addition to Bitcoin, investments in gold are expected to remain robust, driven by its appeal as a hedge against uncertainty. AI-driven sectors, ranging from autonomous systems to biotech innovations, present compelling opportunities for investors seeking exposure to transformative technologies. Private equity and venture capital are also likely to see growth, particularly in emerging industries that stand to benefit from the AI boom.

Uneven growth trajectories characterize the global economic landscape. Global GDP is forecasted to slow to 2.2%, reflecting challenges in major economies outside the US. The US’s robust economic activity offers a counterbalance and highlights its leadership in global growth. While the US continues to outperform with its innovation-driven economy, other regions face more pronounced headwinds. This is why we are overweight domestic equities and credit.

China, for instance, grapples with the dual challenges of geopolitical tensions and tariff pressures, which are likely to dampen its growth potential. Europe, meanwhile, struggles with weak cyclical demand and structural issues that inhibit broader economic recovery. Strategic investments in areas such as Eurozone long-duration bonds or emerging markets like India and the UAE may offer promising diversified returns.

Successfully navigating 2025 requires both cautious planning and adaptive strategies. The US’s economic strength and innovative sectors offer clear opportunities—but the uncertainties surrounding policy changes, global tensions, and market volatility demand vigilance. A key focus should be monitoring the Fed’s actions closely, as even minor deviations from expectations could ripple through markets. Striking the right balance between growth-focused investments and risk mitigation will be key.

This year, it’s also crucial to focus on fundamentals, such as maintaining diversified portfolios, prioritizing long-term objectives, and managing emotions during market turbulence. Lessons from past cycles emphasize the importance of staying invested, as missing out on even a few days of strong market performance can significantly impact returns. By embracing disciplined approaches and avoiding overreaction to short-term noise, we can better position ourselves for success.

At Atlas, we are committed to guiding our clients through this dynamic and complex environment. Our approach emphasizes flexibility and precision, ensuring that investment strategies align with both short-term goals and long-term visions. By staying informed and proactive, we can help you, our clients, seize opportunities while weathering the inevitable challenges.

As we move forward together, let us embrace the journey ahead, finding clarity amidst the fog and confidence in the lighthouse of our shared vision for 2025. Happy New Year!

As the Chief Investment Officer, Stephen Swensen oversees investment management, research, portfolio design, and all investment-related operations at Atlas. He also chairs the Atlas Investment Committee, guiding strategic investment decisions.

Stephen’s career began as a Financial Analyst for Deseret Mutual Benefits Administration (DMBA), a role in which he managed investments for a private pension fund and insurance company. Subsequently, he served as an investment analyst and portfolio manager for local Registered Investment Advisors (RIAs). Before joining Atlas, Stephen contributed his expertise as an Outsourced Chief Investment Officer (OCIO) for the Carson Group, supporting advisors on the West Coast. Educationally, Stephen holds an MBA and an MS in Investment Management and Financial Analysis from Creighton University. He has earned the Series 65 Uniform Investment Advisor License and is actively pursuing the prestigious

Chartered Financial Analyst (CFA) designation.

Beyond his professional achievements, Stephen is an enthusiastic hockey fan, both on and off the ice. He finds joy in playing the piano, golfing, reading, and outdoor cooking. However, his greatest source of happiness comes from spending quality time with his wife and four children

NOTICE REGARDING INVESTMENT DISCLOSURES: The contents of this memo reflect the opinions of the author(s) as of the indicated date and are subject to change without notice. Atlas Investment Management has no obligation to update the information provided here. It should not be assumed that past investment performance guarantees future results. Potential for profit also entails the risk of loss.

The information presented is believed to be current and is not personalized investment advice. All opinions expressed are as of the date of the presentation and may change over time. All investment strategies carry the potential for profit or loss. Asset allocation and diversification cannot guarantee improved returns or eliminate the risk of investment losses. Target allocations may deviate due to market conditions and other factors. There is no guarantee that any investment or strategy will be suitable or profitable for an investor’s portfolio. Different types of investments involve varying levels of risk.

The charts and slides do not depict the performance of Atlas Investment Management or any of its advisory clients. Historical performance returns for investment indexes and/or categories typically do not factor in transaction and/or custodial charges or an advisory fee, which may decrease historical performance results. There is no assurance that an investor’s portfolio will match or exceed a specific benchmark.

This communication, including any attachments, is intended exclusively for the addressee and may contain proprietary, confidential, or privileged information. Unauthorized use, copying, disclosure, dissemination, or distribution is strictly prohibited. If you are not the intended recipient, please immediately notify the sender by return email, delete this communication, and destroy all copies.

Securities are offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC, headquartered at 80 State Street, Albany, NY 12207. Investment Advisory services are offered through Ignite Planners, LLC. Purshe Kaplan Sterling Investments and Ignite Planners, LLC are not affiliated companies. Ignite Planners, LLC conducts business only in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission and does not imply that the advisor has achieved a particular level of skill or ability. All investment strategies carry the potential for profit or loss.