“The music is not in the notes, but in the silence between.” Volume 26

–Claude Debussy (1862–1918), French Composer

Volume 26

The Stock Market Symphony: Finding Harmony in Chaos

What Happened in the Markets

Subscribe and start receiving the Atlas Memo directly to your email

This month’s quote from the renowned French composer, Claude Debussy, resonates deeply in both music and investing. Just as a great symphony is defined not just by the notes played but by the pauses that give it structure, markets are shaped by the balance

between movement and stillness.

Imagine an orchestra preparing for a performance. Each musician tunes their instrument, the conductor raises the baton, and the first notes begin to resonate. The sound is sometimes harmonious; at others, it may feel chaotic as different sections rise and fall in prominence. But the music finds its balance through careful coordination and adherence to the overall composition—delivering a masterpiece.

Financial markets function in much the same way. Investors frequently encounter volatility, much like dissonant moments in a symphony. February was a reminder of this, as short-term turbulence led some to consider changing their investment approach. However, history suggests that those who remain attuned to the overarching melody, rather than reacting to each discordant note, ultimately experience the full richness of the financial cycle.

Recent market activity underscores a fundamental truth: just as a symphony builds through movements of tension and resolution, markets experience periods of short-term turbulence even in the context of long-term expansion. The S&P 500 recently reached an all-time high before experiencing a notable pullback in late February. Such movements, while dramatic in the moment, align with historical trends—post-election years frequently see market softness in February. Despite this, macroeconomic indicators continue to support a bullish outlook. Strong corporate earnings, a resilient labor market, and moderating inflation suggest that equities have some room to run.

Though often jarring, market corrections are essential in sustaining a healthy investment environment. They serve to rebalance valuations, shake out speculative excess, and present opportunities for long-term investors. Just as an orchestra requires discipline and patience to bring a composition to life, maintaining a well-structured investment approach remains paramount for those looking to stay in tune with market cycles.

Investor confidence—often referred to as “animal spirits”—plays a crucial role in economic activity. While broader economic conditions remain strong, there are signs of softening sentiment. Unemployment has edged higher, raising questions about potential economic headwinds. However, it is vital to contextualize such developments. Historically, rising unemployment alone has not been a definitive predictor of economic downturns, particularly in resilient economies such as the one we currently observe.

Market sentiment can be fragile, and uncertainty amplifies reactions to economic data. Policymakers must remain attentive to these dynamics, but investors must also differentiate between cyclical fluctuations and structural risks. While short-term economic indicators may introduce volatility, they do not necessarily signal a deviation from a long-term expansionary trajectory.

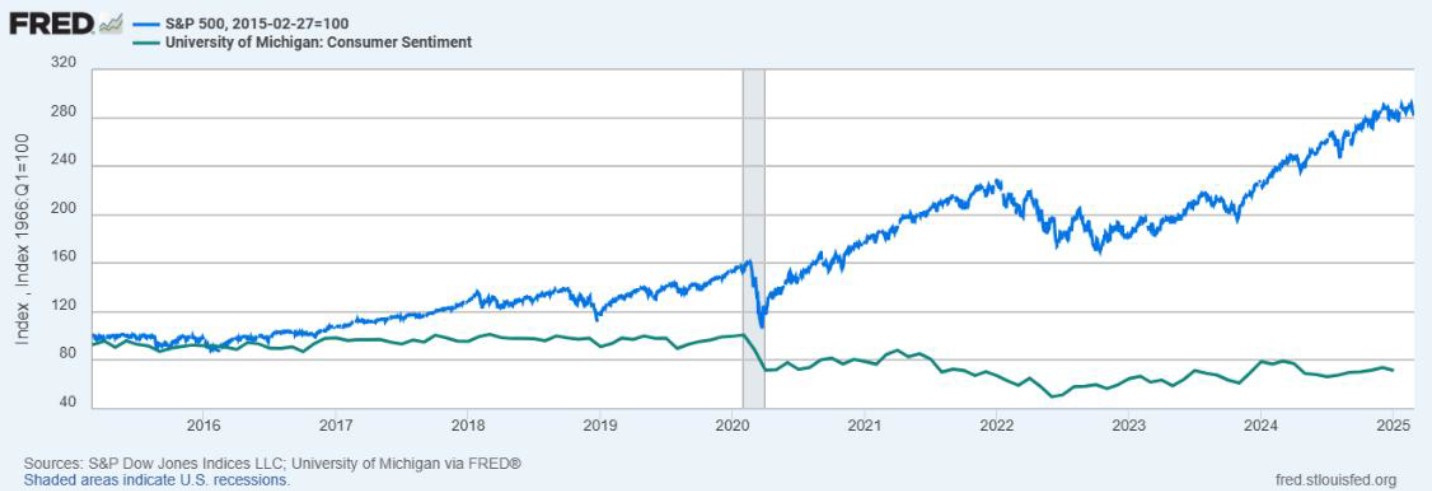

Periods of uncertainty often foster investment opportunities. A helpful way to illustrate this is by comparing investor sentiment with actual market performance. Historically, consumer sentiment has frequently been disconnected from market returns, with investors reacting emotionally to short-term economic concerns while markets continue their long-term upward trajectory.

This chart compares the University of Michigan Consumer Sentiment Index with the S&P 500 over the past decade. As seen, sentiment often bottoms out during periods of market turbulence, yet stock prices tend to rebound well before sentiment improves. This reinforces the importance of maintaining a disciplined investment strategy rather than making reactionary decisions based on short-term economic fears.

Investors who align their decisions with long-term fundamentals rather than short-term sentiment are best positioned for success. The market’s history has shown that negative sentiment can be temporary, with recoveries often materializing more quickly than expected.

A common question investors face is whether to adjust portfolio allocations in anticipation of a potential economic downturn. While this concern is understandable, historical evidence overwhelmingly indicates that market timing is an ineffective investment strategy. Since 1950, the United States has experienced 11 recessions—approximately one every seven years—yet accurately predicting their onset remains a near-impossible task.

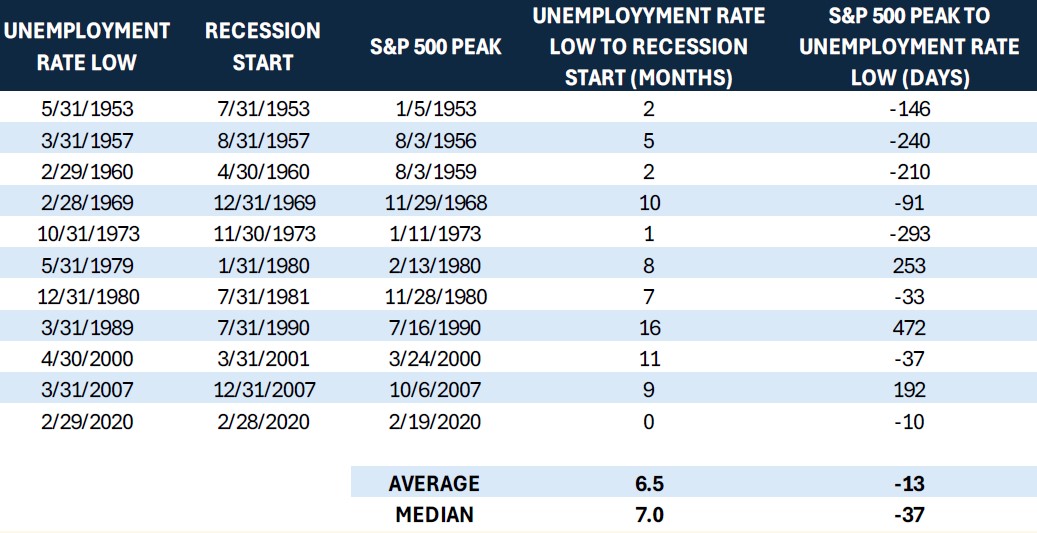

One of the key challenges in market timing is understanding the relationship between unemployment trends and recessions. The chart below illustrates how unemployment rate lows often precede recessions by several months, with stock market peaks typically occurring before unemployment reaches its lowest point. This highlights a fundamental issue with using labor market indicators as recession signals—by the time unemployment starts rising, markets have often already adjusted.

Consider the data to the right to visualize this dynamic better. As the chart shows, the unemployment rate typically bottoms out about seven months before a recession begins, though this timing varies. Additionally, the S&P 500 tends to peak before the unemployment rate reaches its lowest level, meaning that those who attempt to time market exits based on labor data risk making premature decisions. This reinforces the challenge of using economic indicators to guide short-term investment decisions.

February closed on a weak note for domestic markets, with equities

struggling across the board. The S&P 500 ended the month down 1.3%, while small caps saw a sharper decline of 2.9%. Mid caps fared slightly better, finishing the month down 0.7%—the best performance among the major US equity categories.

Market uncertainty was driven largely by ongoing policy concerns, including government actions, Federal Reserve decisions, and persistent inflationary pressures. Additionally, the potential for new tariffs cast a shadow over US markets. This uncertainty was reflected in volatility levels, as the VIX ranked in the top 30% of volatility months over the last two years.

In contrast, international equity markets performed exceptionally well. Developed markets surged 5.1%, while emerging markets gained 2.6%. The Europe, Australasia, and Far East (EAFE) region led global performance with a strong 8.1% return for the month.

Fixed income markets remained resilient as investors sought safety in investment-grade bonds and Treasuries. Both the US Treasury

Index and Aggregate Bond Index posted solid 2.7% returns. High-yield bonds also advanced, gaining 2.1%, though bank loans underperformed the broader fixed income market with a more modest 0.7% return.

The more significant challenge lies not in exiting the market but in determining when to re-enter. Many of the strongest equity gains occur immediately following downturns, meaning that investors who prematurely exit risk missing out on significant recoveries. Instead of attempting to predict market movements, a more practical approach involves maintaining a diversified asset allocation aligned with individual risk tolerance and investment objectives.

Market recoveries can often be sudden and unpredictable, leaving those who exit too early struggling to get back in at the right time. Data consistently shows that missing even a handful of the best-performing days in the market can significantly impact long-term returns. Adopting a systematic and disciplined approach is critical for success rather than trying to react to every short-term movement. A well-structured portfolio accounts for periods of uncertainty and volatility, ensuring investors remain positioned for long-term growth.

For those concerned about market declines, there are alternative strategies that enhance resilience without engaging in speculative timing. Regular portfolio rebalancing, broad diversification, and maintaining appropriate liquidity buffers are all prudent steps that can mitigate risk while preserving long-term growth potential. In investing, preparation is key—but reactionary moves often undermine long-term performance. Many of the strongest equity gains occur immediately following downturns, meaning that investors who prematurely exit risk missing out on significant recoveries. Instead of attempting to predict market movements, a more effective approach involves maintaining a diversified asset allocation aligned with individual risk tolerance and investment objectives.

Returning to our symphony analogy, an orchestra’s performance is not defined by a single note, but by the cohesion of the entire composition. Attempting to overcorrect based on a moment of discord can disrupt the overall harmony, just as frequent short-term trading often leads to missed opportunities in investing.

Investors who cultivate patience, adhere to a disciplined investment framework, and focus on long-term fundamentals are consistently rewarded. The market’s history demonstrates that downturns are temporary, whereas disciplined investment approaches yield lasting benefits.

As we move forward, let’s commit to informed decision-making, measured responses, and a focus on long-term value creation. Much like a seasoned musician, a prudent investor understands that success lies in preparation, adaptability, and confidence in the broader composition. Stay invested, stay informed, stay the course.

As the Chief Investment Officer, Stephen Swensen oversees investment management, research, portfolio design, and all investment-related operations at Atlas. He also chairs the Atlas Investment Committee, guiding strategic investment decisions.

Stephen’s career began as a Financial Analyst for Deseret Mutual Benefits Administration (DMBA), a role in which he managed investments for a private pension fund and insurance company. Subsequently, he served as an investment analyst and portfolio manager for local Registered Investment Advisors (RIAs). Before joining Atlas, Stephen contributed his expertise as an Outsourced Chief Investment Officer (OCIO) for the Carson Group, supporting advisors on the West Coast. Educationally, Stephen holds an MBA and an MS in Investment Management and Financial Analysis from Creighton University. He has earned the Series 65 Uniform Investment Advisor License and is actively pursuing the prestigious

Chartered Financial Analyst (CFA) designation.

Beyond his professional achievements, Stephen is an enthusiastic hockey fan, both on and off the ice. He finds joy in playing the piano, golfing, reading, and outdoor cooking. However, his greatest source of happiness comes from spending quality time with his wife and four children

NOTICE REGARDING INVESTMENT DISCLOSURES: The contents of this memo reflect the opinions of the author(s) as of the indicated date and are subject to change without notice. Atlas Investment Management has no obligation to update the information provided here. It should not be assumed that past investment performance guarantees future results. Potential for profit also entails the risk of loss.

The information presented is believed to be current and is not personalized investment advice. All opinions expressed are as of the date of the presentation and may change over time. All investment strategies carry the potential for profit or loss. Asset allocation and diversification cannot guarantee improved returns or eliminate the risk of investment losses. Target allocations may deviate due to market conditions and other factors. There is no guarantee that any investment or strategy will be suitable or profitable for an investor’s portfolio. Different types of investments involve varying levels of risk.

The charts and slides do not depict the performance of Atlas Investment Management or any of its advisory clients. Historical performance returns for investment indexes and/or categories typically do not factor in transaction and/or custodial charges or an advisory fee, which may decrease historical performance results. There is no assurance that an investor’s portfolio will match or exceed a specific benchmark.

This communication, including any attachments, is intended exclusively for the addressee and may contain proprietary, confidential, or privileged information. Unauthorized use, copying, disclosure, dissemination, or distribution is strictly prohibited. If you are not the intended recipient, please immediately notify the sender by return email, delete this communication, and destroy all copies.

Securities are offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC, headquartered at 80 State Street, Albany, NY 12207. Investment Advisory services are offered through Ignite Planners, LLC. Purshe Kaplan Sterling Investments and Ignite Planners, LLC are not affiliated companies. Ignite Planners, LLC conducts business only in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission and does not imply that the advisor has achieved a particular level of skill or ability. All investment strategies carry the potential for profit or loss.