The Atlas Investment Platform presents a one-of-a-kind solution that enables Advisors to offer portfolios tailored to their clients’ needs. The advisor collaborates with the investment team, who ensures the underlying positions are managed with utmost efficiency, scale and ease. You may be wondering, how is this achievable?

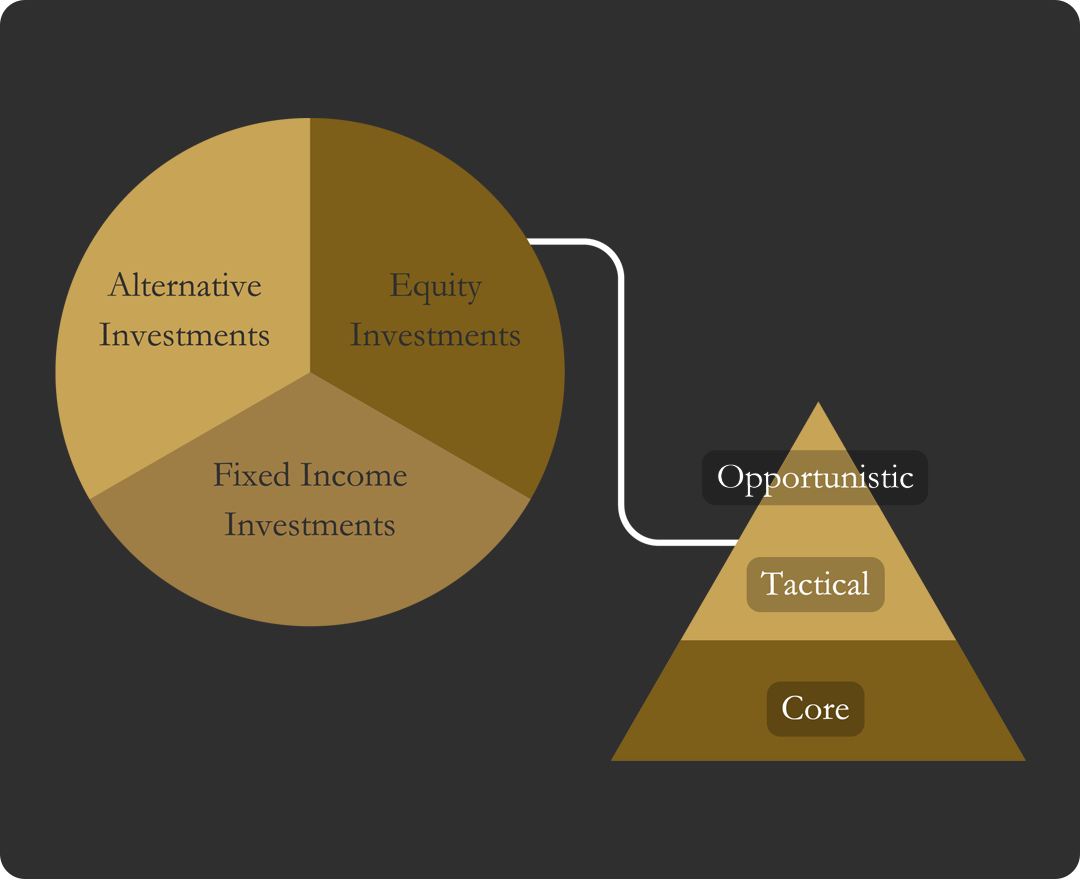

When discussing investment platform, we often separate a client’s assets into three distinct categories or sleeves: Core, Tactical, and Opportunistic. Core consists of steady, reliable investments that lay a strong foundation for a portfolio. Tactical and Opportunistic sleeves, however, focus on timely investments that utilize specific investment strategies to potentially provide higher returns. We carefully evaluate each aspect of the portfolio, including equity, fixed income, and alternative investment allocations, based on the client’s unique risk tolerance. The result is a personalized portfolio tailored to meet each client’s unique investment goals and risk tolerance–setting them apart from others.

We pride ourselves on our innovative investment management approach, which involves using proprietary investment sleeves. Our team of seasoned professionals meticulously curates collections of individual stocks, ETFs, and mutual funds that are customized to meet specific investing objectives. So you can invest with peace of mind. This approach helps minimize costs and provides advisors with a personalized platform to present tailored portfolios to their clients. We are committed to ensuring your investments align with your core values and beliefs.

“We subscribe to the principles of Modern Portfolio Theory, which underscores the uniqueness of each client’s investment needs. To that end, we craft individualized investment portfolios for each of our esteemed clients utilizing our sleeve approach. A critical aspect of our portfolio management strategy is identifying your risk tolerance level. Through a comprehensive discovery process, we work closely with you to determine the level of risk you are willing to undertake in pursuit of your financial goals. Upon onboarding new clients, we often discover that they may have unknowingly overexposed themselves to risk in relation to their aspirations. We are well-equipped to design a strategy that mitigates such risk. In our opinion, determining an optimal asset allocation for an individual or family goes beyond a generic, predetermined model and requires careful consideration. Instead, we believe that the most ‘efficient’ portfolio may not be the best fit if it does not instill a sense of security in you. Our experienced advisors consider your risk profile and create a tailored portfolio that aligns with your financial objectives. This customized portfolio not only helps you achieve your financial goals but also provides you with the peace of mind that you deserve. Moreover, we keep the fees low while offering a unique portfolio that is not a cookie-cutter solution.”

– Stephen Swensen, CIO